Today’s Labor Updates;

Unions, chambers of commerce form alliance to push for energy pipelines

Striking Texas refinery workers say reach tentative pact with Marathon

Here Are the “Tectonic Shifts” That BP Says Are Rocking the Global Oil Market

Unions, chambers of commerce form alliance to push for energy pipelines

Jun 9, 2015, 11:05am EDT Updated Jun 9, 2015, 1:38pm EDT

Patricia Madej Contributor

The oil and gas extraction industry – one that grew by about 6,000 jobs between 2010 and 2013 according to the U.S. Census Bureau – has a newly formed supporter: the Pennsylvania Energy Infrastructure Alliance.

The coalition, which formed Monday and has been in the works for the past few months, partners the Washington County Chamber of Commerce, the Delaware County Chamber of Commerce, the Laborers’ International Union of North America (LiUNA) and the International Union of Operation Engineers (IUOE) Local 66 toward a common goal of gaining support and funding for energy infrastructure in Pennsylvania. Namely, pipelines.

“We’re just trying to make ourselves competitive and make sure everyone is educated so when decisions will need to be made, the right decision makers will have the correct information,” said Trish McFarland, president of the Delaware County Chamber of Commerce.

The alliance sees long-term benefits like job and economic growth from the unionized workers constructing the pipelines to the money they spend in the local restaurants and markets during their lunch breaks. Not to mention the money that’ll be made from the product itself making its way into the homes and businesses across the state.

They look to create “tens of thousands of jobs” and also bring in tax revenue across the commonwealth.

Various members of the coalition pointed to Sunoco Logistics’ proposed plan to build additional pipelines from Marcellus Shale to nearby Marcus Hook, an extension to the Mariner East II pipeline project, as a perfect example of economic growth and opportunity.

“That will create a significant number of jobs,” said James Kunz, business manager of IUOE Local 66. “Western Pennsylvania is blessed with a resource that’s high in demand,” he later added.

Fran Ferrell, 26 and a manager at the Marcus Hook Deli, said business drops significantly when the nearby refineries aren’t at work. He said he looks forward to seeing what the coalition can accomplish, especially if it brings in the business and the money to follow.

But not all are on board with the alliance’s efforts. Activists like Iris Marie Bloom, the executive director for Protecting Our Waters, an organization that fights against shale gas extraction said the PEIA is a step in the wrong direction.

Bloom said the negative environmental impact from leaking and contamination is far too great to be ignored. As far as job growth goes, she said she sees a greater economic benefit in investing in greener solutions like solar power or geothermal energy.

And the alliance, Bloom said, is big business banning together.

“This is a David vs. Goliath situation and Goliath just got bigger,” Bloom said.

Anti-extraction efforts have been made across the country. New York has bans fracking while Maryland followed suit earlier this month. Pennsylvania Gov. Tom Wolf is proposing a severance tax on natural gas drilling.

But members of the coalition aren’t much deterred. Members said PEIA hasn’t seen much pushback so far and will try to gain its funding by backing private companies rather than by lobbying for state funding. They’ll look to support the companies that have the money to invest in the infrastructure.

McFarland also said the “economic investment is too much” to not take advantage of the partnership. She also said another goal of the coalition is to turn Philadelphia into an “energy hub” – a term that’s been thrown at the city in recent years given its opportunity for economic development and eventual growth.

As far as when the city and the state will see the work of the alliance, it’s hard to say,

“I don’t know when we’ll see the effects,” McFarland said. “Hopefully sooner rather than later.”

US | Mon Jun 8, 2015 9:24pm EDT

Related: U.S.

Striking Texas refinery workers say reach tentative pact with Marathon

Negotiators for Marathon Petroleum Corp and union workers at the company’s Galveston Bay, Texas, refinery reached a tentative agreement on Monday for a four-year contract, pointing to the end of a walkout that has lasted four months, said local union officials.

Before strikers can leave their picket lines outside the 451,000 barrel-per-day (bpd) refinery in Texas City, Texas, United Steelworkers union (USW) Local 13-1 and Marathon will have to complete a return-to-work agreement and union members will have to vote on the contract.

The walkout at the Galveston Bay refinery is the last of 15 work stoppages that began in February after talks for a new national agreement between the USW and U.S. refinery and chemical plant owners broke down.

“Obviously, the union is optimistic about being able to negotiate a favorable return-to-work agreement to get our members back to work,” said USW Local 13-1 Vice President Larry Burchfield on Monday night. “We’re glad we were able to reach a safe and fair contract after this long strike.”

The more than 1,000 Galveston Bay Refinery workers represented by Local 13-1 went on strike on Feb. 1, one of the first locals called off their jobs by the USW’s international leadership.

The local is the last to complete a contract, nearly three months after a national agreement on wages, benefits and safety policies was reached by the USW International and refinery owners.

The long and bitter dispute at the Galveston Bay Refinery was over changes Marathon sought to long-standing policies at the refinery, which the company bought from BP Plc two years ago. The union said those changes would remove job and safety protections for workers.

Local 13-1 members twice rejected contract offers made by the company.

Marathon representatives did not reply to requests for comment on Monday night.

Local union and company negotiators are scheduled to begin talks on Tuesday morning over the return-to-work agreement, which will lay out the schedule and terms for strikers to resume their jobs.

Marathon has employed temporary replacement workers to keep the refinery in operation.

How long it will take to reach the return-to-work agreement, which must be ratified along with the contract, is unknown.

In 14 other strikes at U.S. refinery and chemical plants this year, it has taken about three weeks for striking workers to return to their jobs after the ratification vote.

Here Are the “Tectonic Shifts” That BP Says Are Rocking the Global Oil Market

Jeff Reed

posted 06102015

“We have truly witnessed a changing of the guard of global energy suppliers,” BP said in its 2015 Statistical Review released Wednesday. For the first time since 1975, the US surpassed Russia and Saudi Arabia as the world’s top oil producer.

As we know, this is a mixed blessing, as it speaks to both the emergence of the US as a global oil powerhouse and the corresponding supply glut that has convulsed the oil market over the last year, depressing prices and prompting much of the sector to curtail investment, cut jobs and scale back operations.

What follows are takeaways from BP’s annual report that detail what the major sees as the “tectonic shifts” that have occurred in the past year in the oil market.

US Becomes Top Global Oil Producer

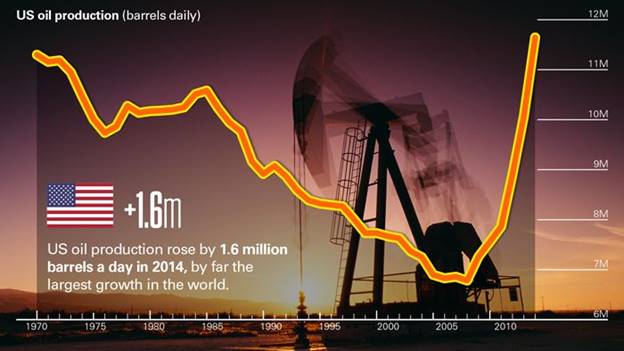

US oil production rose by 1.6 M/bpd in 2014, representing by far the largest growth in the world, and taking its overall production to just north of 11.5 M/bpd. This marks the first time any country has raised its production by more than 1 M/bpd for three straight years.

BP CEO Bob Dudley said in the opening of the report, “The US replaced Saudi Arabia as the world’s largest oil producer – a prospect unthinkable a decade ago. The growth in US shale gas in recent years has been just as startling, with the US overtaking Russia as the world’s largest producer of oil and gas.”

Consequently, US oil output in 2014 surpassed the previous peak level of US production achieved in 1970. BP makes the significant observation that this fact directly challenges “Peak Oil Theory,” which posits that the world will never be able to produce as much oil as it did in the past. For the US to exceed its 1970 peak is thus meaningful, and speaks to the successful utilization of technologies such as horizontal drilling and hydraulic fracturing to unlock previously inaccessible reserves.

Source: BP Annual Statistical Review

It also means the US passed both Saudi Arabia and Russia to emerge as the world’s leading oil producer for the first time since 1975. BP notes, “We have truly witnessed a changing of the guard of global energy suppliers.”

The US Wasn’t The Only Record Breaker

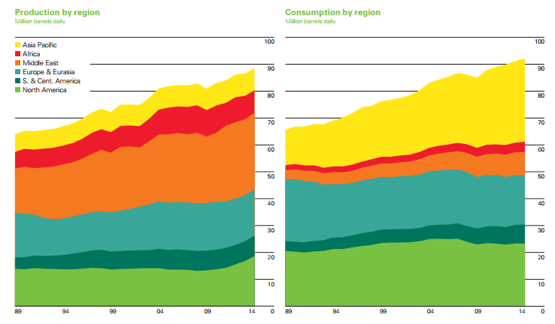

Driven by the strength of US oil production, non-OPEC countries increased their supply by 2.1 M/bpd last year – the largest increase ever seen from non-OPEC output. This growth figure represents more than double its ten-year average.

Source: BP Annual Statistical Review

As noted above, this supply increase was a root cause of the global supply glut seen in the oil market over the last year, as well as the adjustment the industry is now enduring in terms of low oil prices.

Among non-OPEC producers, Canada and Brazil also saw record increases in oil production last year.

Demand Growth Slowed Sharply

Global primary energy consumption increased by only 0.9% in 2014, its slowest rate of growth since the late 1990s, other than immediately following the 2008 financial crisis. This sharp deceleration in demand occurred despite the global economy expanding at 3.3%, a similar rate to 2013.

This slowdown was caused principally by the rebalancing of China’s economy away from energy intensive sectors causing the growth of energy consumption in the Asian nation to slow to its lowest level since 1998.

The report noted, “The big picture for energy in 2014 was one of surprisingly weak growth in energy consumption; with supply growth outstripping demand and a consequent softening in energy prices.”

Energy consumption grew more slowly than recent averages in all regions, with the exceptions of NAM and Africa. “Overall, it’s a significant slowdown relative to the previous year, some of which can be explained by weather-related factors in both the US and Europe, but a fundamental driver is what happened in China,” the report said.

Source: BP Annual Statistical Review

Oil remained the world’s leading fuel, with 32.6% of global energy consumption, but lost market share for the fifteenth consecutive year. Growth in 2014 slowed for every fuel other than nuclear power, which was also the only fuel to grow at an above-average rate.

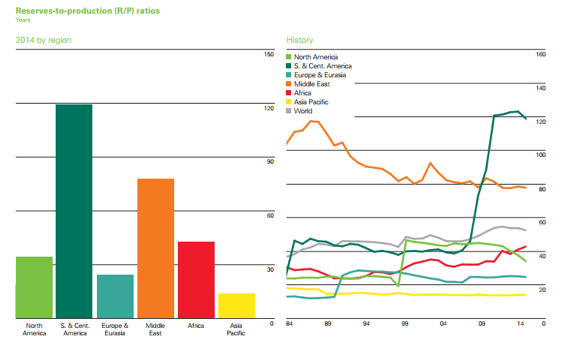

Largest Addition Of Reserves Came From Saudi

Total global proved oil reserves reached 1700.1 billion barrels at the end of 2014, enough to meet 52.5 years of global production. The largest addition to reserves came from Saudi Arabia, which added 1.1 billion barrels. Meanwhile, the largest decline came from Russia, where reserves fell by 1.9 billion barrels.

The report said OPEC countries continue to hold the majority of the world’s reserves, accounting for 71.6% of the global total. South & Central America continues to hold the highest R/P ratio, more than 100 years.

Source: BP Annual Statistical Review

Over the past decade, global proved reserves have increased by 24%- more than 330 billion barrels.