Today’s Labor Updates:

China Flexes Might With Energy Giants

Independent contractors for global organizations

EEOC issues new enforcement guidelines regarding pregnancy discrimination

China Flexes Might With Energy Giants

South China Sea Quarrel Chills Drilling by Some Oil Companies

By Brian Spegele and Chester Dawson

Updated July 16, 2014 1:40 p.m. ET

Executives at Talisman Energy Inc. are excited about promising oil-and-gas prospects off the coast of Vietnam and the Canadian company is gearing up to drill two exploratory wells there this year.

“I would describe these as world-class exploration blocks,” says Paul Ferneyhough, the Calgary, Alberta, company’s vice president for Asia-Pacific operations. The U.S. calculates that the South China Sea likely holds nearly 11 billion barrels of oil and 190 trillion cubic feet of natural gas.

There is a problem: Proceeding with drilling could bring Talisman into conflict with China, which claims some of the blocks as its own. Talisman declined to comment on China’s position. Mr. Ferneyhough accepts Vietnam’s assurances that Talisman has the right to explore there.

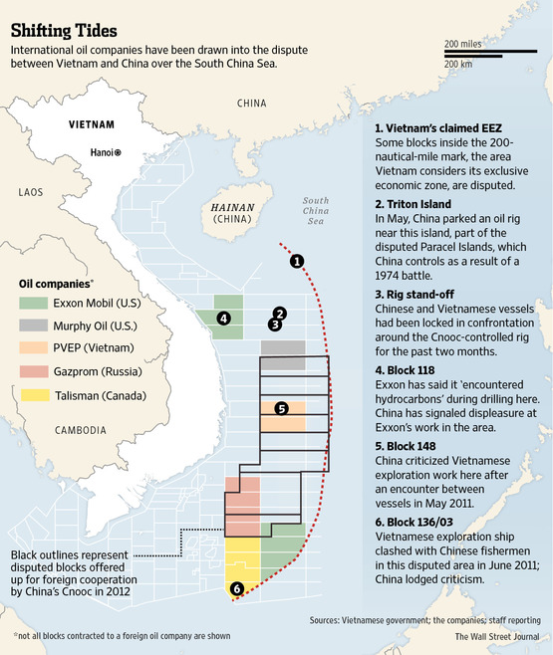

For years, the drive to tap the South China Sea’s potential riches has placed global oil companies in the center of a quarrel between China and Vietnam over which country owns the resources. Companies that have gotten caught up include Exxon Mobil Corp. , Chevron Corp. , ConocoPhillips Co. , and BP PLC.

In May, tensions flared anew when state-owned China National Offshore Oil Corp. sailed a billion-dollar oil rig into waters claimed by Vietnam, prompting a standoff between Chinese and Vietnamese government vessels.

On Tuesday, China said it had completed drilling for now and was withdrawing the rig from the waters, in a potential easing of the standoff. But China’s Foreign Ministry left the door open to future exploration there.

Neither Talisman nor U.S.-based Harvest Natural Resources Inc., which hold rights assigned by China to an area separately assigned by Vietnam, has started drilling in the flash point areas. Harvest Chief Executive James Edmiston told an industry conference in June that the company was in the process of exiting its China interests.

Some companies have been undeterred. Exxon in 2009 acquired the rights to explore more than 13 million acres off the coast of Vietnam, all within an area Vietnam considers its exclusive economic zone under a United Nations maritime convention. Some of that acreage, however, is contested by China.

Still, Exxon and its state-owned partner, PetroVietnam, drilled two successful wells in 2011 and 2012 in the South China Sea. Exxon said in March it expected to drill an additional well this year as it evaluates a multibillion-dollar natural-gas project in Vietnam. A company spokeswoman said disputes of sovereignty are for governments to resolve, and declined to comment on the status of its drilling plans there.

The standoff over which companies can drill and where represents a test of the Obama administration’s ability to convince China to dial back recent confrontations with Vietnam and the Philippines without damaging wider U.S.-China ties. The U.S. also fears Chinese control over contested waters could one day impede the ability of its forces to operate there, say observers. Secretary of State John Kerry pressed Chinese officials on the issue during a visit to Beijing last week.

The U.S. has taken moderate steps to heighten pressure on Beijing in recent months over its sea disputes. Daniel Russel, assistant secretary of State for East Asian and Pacific Affairs, said in congressional testimony in February that China’s claims over nearly the entire South China Sea had no apparent basis in international law.

China flatly rejects what it sees as U.S. meddling in its territorial disputes.

Senior U.S. diplomats have rarely made public reference to the challenges faced by U.S. companies in the South China Sea. A State Department official declined to offer details on how the U.S. and China have dealt with the matter, adding the U.S. supported expanding economic ties between the U.S. and Vietnam.

The size of China’s energy market and the growing global clout of its oil companies give it some unique strength in dealings with international oil firms. For Vietnam, meanwhile, teaming up with international companies is crucial to tapping new reserves of harder-to-reach oil and gas.

“We want to tell the international community: Don’t expect China to stop drilling after Vietnam’s shouting,” said Wu Shicun, president of China’s National Institute for South China Sea Studies, referring to a recent flare-up over Cnooc’s drilling rig in waters claimed by Vietnam. The company says it has every right to operate in the disputed waters.

PetroVietnam officials protested Cnooc’s move. Nguyen Quoc Thap, deputy director at PetroVietnam, said last month that international oil companies have pledged to continue offshore work there.

Exxon and PetroVietnam executives last year met in Washington, D.C., and pledged to advance cooperation. Exxon’s business exposure in China is more limited than some competitors. The company’s interest includes a minority stake in a south China refinery and a gas exploration agreement with PetroChina Co. in northern China’s Ordos Basin.

Murphy Oil Corp. , which has no operations in China, similarly agreed to move ahead on exploration off Vietnam. A spokesman for the Arkansas-based company said it is seeking additional opportunities in Vietnam.

But other companies have been less willing to test Beijing’s resolve. In, 2006, Chevron signed with Malaysia’s state oil company Petroliam Nasional Bhd., or Petronas, to explore a block east of Vietnam. China warned Chevron executives its operations there violated Chinese sovereignty.

The Vietnamese offered its navy for protection, according to one diplomatic cable released by WikiLeaks, but Chevron suspended planned seismic work in the block in 2007, citing the China-Vietnam dispute as the reason in a U.S. regulatory filing. It no longer is pursuing work in that area.

Chevron now is pursuing drilling in Vietnam, but not in a disputed area. In June, Italian oil company Eni SpA signed a production-sharing contract with PetroVietnam to explore the area Chevron originally was pursuing.

Royal Dutch Shell PLC and PetroChina have agreements on exploring shale in Sichuan and on cooperation overseas. Shell also works with Cnooc. During a visit to the U.K. by Premier Li Keqiang in June, Shell and Cnooc signed what they called a “global strategic alliance” agreement.

—Daniel Gilbert in Houston and Vu Trong Khanh in Hanoi contributed to this article.

Write to Brian Spegele at brian.spegele@wsj.com and Chester Dawson at chester.dawson@wsj.com

Independent contractors for global organizations

Annie Lau Global, USA

July 14 2014

As the global market grows seemingly smaller, more and more companies are expanding their reach around the world. Some companies send U.S. employees overseas, while others hire locally, or even utilize local independent contractors. As in the United States, companies must be mindful of the risks involved when hiring independent contractors in their international operations.

While different countries have different levels of scrutiny when it comes to determining who is an independent contractor and who is an employee, many of the principles remain the same. The main questions deal with the company’s control over the person’s work. Thus, if you are considering hiring independent contractors overseas, or already do, these are some questions to consider:

- Does the company control what the worker does or how the worker goes about completing a task? If the company controls when and where the work is done, what tools or equipment to use, what order or sequence to follow in completing a task, then this may indicate that the business has a right to direct and control how the worker does the task and may implicate an employee-employer relationship instead of an independent contractor relationship. An independent contractor typically controls where, when, and how they work.

- Does the company provide training to the worker? Independent contractors typically use their methods to complete a project. Thus, if a worker must be trained to perform the work in a particular manner, this may indicate an employer-employee relationship.

- Does the worker provide services to other clients? If the worker exclusively works for the company, this is a strong indicator that there is an employer-employee relationship. If the worker provides services for the company on a full-time basis on a continuing basis, they may be deemed an employee. Also, if the worker is required to enter into some form of non-competition agreement with the company and is forbidden to work for other companies, this will further implicate an employer-employee relationship.

- Does the worker control his/her opportunity for profit and loss? An independent contractor typically invests in his/her own supplies, tools, equipment, and determines the manner in which the work is done. If the company pays the worker on a project basis, then the independent contractor maximizes his/her profit by working efficiently and controlling costs. Further, the independent contractor’s earnings are not limited to and controlled by one company.

- Does the worker provide a service that is part of the company’s core business? If the worker performs the same tasks that the company’s employees do, then it is likely that the company will have the right to direct and control his/her activities, and there is an employer-employee relationship.

Misclassifying a worker as an independent contractor can have serious and costly consequences. It will be important to assess the local laws of the country in order to determine the necessity for permits, contract requirements, language requirements, how to best structure payments, what type of entities to best enter into a contract with (a company versus an individual), indemnity provisions, tax implications, and other implications.

Below are a few examples of independent contractor considerations in other countries:

- Canada – In Canada, certain factors must be considered when determining if a worker is an employee or self-employed individuals. These factors differ depending on the Province or Territory law which governs the arrangement. For example, under the law in Ontario there are employees, independent contractors, and dependent contractors. Like independent contractors, dependent contractors have their own businesses and do not have the usual characteristics of employees (e.g. health benefits, etc.). However, dependent contractors often work exclusively for one company and may perform essential functions for that company. Due to this reason, dependent contractors are typically entitled to longer reasonable notice if the other party intends to end the relationship. Dependent contractors are typically treated as “self-employed” for income tax purposes.

- China – There is technically no concept of “independent contractor” in China. Employment relationships are governed by extensive labor law, employment contract law, and various rules. However, there is a labor-service relationship that is akin to the concept of independent contractor. The labor-service relationships are governed by the Civil Code and the Contract Law. Foreign corporations who do not have permanent establishments in China may engage with “labor-dispatch service companies” which hire employees and then second them to work for other entities through labor-service secondment contracts. These workers are considered employees of the labor-dispatch companies.

- India – India is divided into several states, each with its own labor laws. These laws are applied differently depending on the type of laborer in question. Work with independent contractors is permitted in India under the Contract Labour Act, 1970. However, if the business is not of an “intermittent nature” in respect to the contract entered into by it with a third party contractor, the company may be regarded as a principal employer. There are also various tax risks for a U.S. company that engages independent contractors in India.

It is of course always important to be mindful of U.S. laws when employing independent contractors overseas. A company’s tax responsibilities in the United States will be determined on whether the international independent contractor is properly classified. The company will also need to be familiar with its state’s requirements regarding the classification and/or misclassification of independent contractors. For example, in California, all “California businesses” must report their use of independent contractor if it pays the contractor $600 USD or more for services performed “in or outside California.” This includes independent contractors outside of the U.S. if the company is headquartered in California. There are also reporting obligations for companies simply operating in California. Accordingly, the proper classification of independent contractors versus employees is critical in ensuring both U.S. and international law compliance. Companies should keep these considerations in mind in order to develop an effective international independent contractor relationship.

EEOC issues new enforcement guidelines regarding pregnancy discrimination

Mark Fijman USA

July 15 2014

Since the start of 2014, the EEOC has filed a series of lawsuits pursuant to the Pregnancy Discrimination Act of 1978 (“PDA”), with more lawsuits likely to follow. The PDA prohibits employment discrimination on the basis of pregnancy, childbirth or related medical conditions, and requires employers to treat pregnant employees the same as any other similarly situated non-pregnant employee. The increased litigation should not come as a surprise since, in its Strategic Enforcement Plan, the EEOC announced it would prioritize issues relating to pregnancy-related limitations and the need for accommodations.

On July 14, 2014, the agency issued new enforcement guidelines on pregnancy discrimination, which may be viewed at the EEOC’s website (www.EEOC.gov). This is the first comprehensive guidance issued by the EEOC since 1983, and in addition to addressing employers’ obligations under the PDA, it also discusses the application of the Americans with Disabilities Act (“ADA”) to pregnant employees and under what circumstances an employer must provide the reasonable accommodation required under the ADA. Unlike the ADA, the PDA itself does not impose a reasonable accommodation requirement on employers.

Although pregnancy itself is not a disability, pregnant workers may have impairments related to their pregnancies that qualify as disabilities under the ADA. Amendments to the ADA made in 2008 make it much easier than it used to be to show that an impairment is a disability. A number of pregnancy-related impairments are likely to be disabilities, even though they are temporary, such as pregnancy-related carpal tunnel syndrome, gestational diabetes, pregnancy-related sciatica, back pain, preeclampsia and post-partum depression.

An employer may not discriminate against an individual whose pregnancy-related impairment is a disability under the ADA and must provide an individual with a reasonable accommodation if needed because of a pregnancy-related disability, unless the accommodation would result in undue hardship, meaning significant difficulty or expense.

According to the EEOC guidelines, examples of reasonable accommodations that may be necessary for a pregnancy-related disability include:

- Redistributing marginal or nonessential functions (for example, occasional lifting) that a pregnant worker cannot perform, or altering how an essential or marginal function is performed;

- Modifying workplace policies by allowing a pregnant worker more frequent breaks or allowing her to keep a water bottle at a workstation even though the employer generally prohibits employees from keeping drinks at their workstations;

- Modifying a work schedule so that someone who experiences severe morning sickness can arrive later than her usual start time and leave later to make up the time;

- Allowing a pregnant worker placed on bed rest to telework where feasible;

- Granting leave in addition to what an employer would normally provide under a sick leave policy;

- Purchasing or modifying equipment, such as a stool for a pregnant employee who needs to sit while performing job tasks typically performed while standing; and

- Temporarily reassigning an employee to a light duty position.

Employer obligations under the PDA are also the focal point of a case soon to be reviewed by the United States Supreme Court. Less than two weeks before the EEOC issued its guidance, the United States Supreme Court announced it was going to review a case involving an employer’s obligations under the PDA.

On July 1, 2014, the Court agreed to decide whether the PDA requires an employer who provides workplace accommodations to non-pregnant employees with physical limitations to also offer the same accommodations to pregnant employees who were similar in their ability or inability to work. The case being appealed is Young v. United Parcel Service,[1] in which a pregnant driver for the company, whose job involved loading and delivering packages, claimed her rights under the PDA were violated when she was denied alternative work assignments during her pregnancy. Under a collective bargaining agreement, the company provided such alternative work assignments to employees who were unable to perform their regular duties because of an on-the-job injury, or because of a condition or impairment that qualified as a disability under the ADA. The district court granted summary judgment in favor of the company on the basis that Young could not show evidence of discrimination or that the policy was a pretext for discrimination. The United States Court of Appeals for the Fourth Circuit affirmed the decision. The Supreme Court will hear the case during its 2014-2015 term.

In light of the release of the EEOC guidelines and in anticipation of the ruling by the Supreme Court, it would be a prudent practice for employers to carefully review their maternity leave policies and procedures and to consider any reasonable accommodation requests related to pregnancy or pregnancy-related conditions.