Today’s Labor Updates:

Unions Set High Goal: Collective Bargaining for All Workers

Pensions back on the EU agenda

Canada Aims to Sell Its Oil Beyond U.S.

June 5, 2014, 7:07 AM ET.

Unions Set High Goal: Collective Bargaining for All Workers

By Melanie Trottman

Organized labor has embarked on a project to develop legislation that would expand collective bargaining rights of private-sector workers, AFL-CIO President Richard Trumka said.

During and after a meeting with Wall Street Journal reporters and editors Wednesday, Mr. Trumka wouldn’t provide specifics about labor’s plan or timing. But he suggested employers should be required to bargain over wages with all private-sector workers — union members and nonunion workers alike.

“We believe nonunion workers should be able to come together and negotiate with their employer without fear of retaliation or firing to get a better wage, to get a fairer share of what they produce,” he said. “Without collective bargaining, how do we close that gap” of income inequality? Mr. Trumka asked.

“We’re going to try to get … enacted in the law that every worker should have the right to bargain collectively with their employer, whether they have a union or not,” he said.

Any legislative proposal to expand bargaining rights is likely to draw a backlash from business groups, and would have no chance of clearing Congress anytime soon.

One labor official familiar with the effort said the bill would be unveiled as part of a long-term education and messaging campaign intended to “start a conversation” about expanding workers’ bargaining rights. “As politics changes, maybe it will get through” Congress, the official said, adding that while a bill is not imminent, it is under “active discussion,” including with congressional aides.

The 1935 National Labor Relations Act already extends collective bargaining rights to private-sector workers, but it does so under a set of circumstances that are more limited than what organized labor wants.

Existing law doesn’t require workers to be represented by a union to collectively bargain — at least not in the traditional sense of what a union is. Employees have the right to collectively bargain if they can demonstrate that they’re part of a “labor organization” that represents a majority of the workers, labor lawyers say. The term “labor organization” is broader than a union, including any organization, agency, committee or plan, in which employees participate for the purpose of dealing with employers about labor disputes, wages, work schedules or other working conditions.

It isn’t clear if organized labor would seek to legally require employers to bargain without a labor organization in place. Under existing law, private-sector workers can take collective action on their own, such as approaching their employer to try to improve wages, benefits or other working conditions. Employers can’t retaliate but aren’t required to negotiate with the workers.

Some worker advocates contend that under current law, employers could be made to bargain with a labor organization that represents only a minority of workers. But the National Labor Relations Board, which enforces the 1935 labor law, doesn’t order employers to do so. It’s not clear if organized labor would raise that issue in the legislation it plans to propose.

Union membership has fallen sharply since the 1980s. Last year, 11.3% of wage and salary workers belonged to a union, down from 20.1% in 1983. The rate remained flat last year compared to 2012, when unions managed to add members in the private sector, driven by gains in industries such as construction, manufacturing , health-care and food services. Still, rates remain far below what unions want, sapping them of membership dues they use in part to build political power.

Pensions back on the EU agenda

Publication Date: 23 April 2014 | Author(s): Georgina Beechinor (Sacker and Partners, United Kingdom), An Van Damme (Claeys & Engels, Belgium)

Member Firm(s): Sacker and Partners (United Kingdom); Claeys & Engels (Belgium)

On 27 March 2014, the European Commission published a proposal for a new Occupational Pension Funds Directive.

Long awaited, the draft builds on the original 2003 Directive, with a view to bringing occupational pensions into the more transparent era of good governance that is emerging from the ashes of the global financial crisis. As such, key aims of the new Directive are to introduce clearer and more consistent member communications across EU Member States, to remove remaining barriers for cross-border IORPS1 as well as measures to support the EU Commission’s roadmap to meet the long-term financing needs of the European economy.

Key points

- The proposal for a new European Directive for occupational pension schemes focuses on governance and risk management, transparency and facilitating cross-border activity.

- With an eye to improving the long-term financing of the European economy, the Commission anticipates that its proposal will better enable pension schemes to invest in assets with a long-term economic profile.

- Provisions relating to solvency and capital requirements are not part of the present proposals, although they are expected to make a comeback later in the year.

It is anticipated that Member States will be required to implement the Directive into national law by 31 December 2016.

Background

As with much of the new legislation relating to the financial sector, one of the main drivers for the Commission’s proposals on pensions is the 2008 financial crisis and the need to deal with the perceived lack of governance and transparency. Set against the backdrop of individuals in some Member States seeing their pensions reduced, scheme members increasingly bearing the financial risk through greater use of DC, and an ever ageing population, it is unsurprising that the draft Directive aims to ensure the security and adequacy of members’ benefits in retirement.

The Commission is also keen to encourage greater take-up of cross-border pensions, by making it easier for schemes to comply with the social and labour law provisions of other Member States, and introducing a procedure for transferring pension schemes (in whole or in part) between Member States.

Objectives

The Commission’s proposals are underpinned by four main objectives:

- removing remaining prudential barriers for cross-border IORPs,

- ensuring good governance and risk management,

- providing clear and relevant information to members and beneficiaries

- ensuring that supervisors have the necessary tools to effectively supervise IORPs.

Moreover, the proposal wants to encourage occupational pension funds to invest long-term in growth, environment and employment enhancing economic activities.

Improving governance

The proposal provides for the following governance measures and requirements :

- All persons who effectively run the IORP or have other key functions need to be fit and proper for the role. It is suggested that such individuals will have “professional qualifications, knowledge and experience which are adequate to enable sound and prudent management” of the scheme and that they “are of good repute and integrity”.additional requirements on key functions, including risk management, internal audit and, where relevant, actuarial function and have in place written policies in these fields

- a requirement for schemes to have a remuneration policy, including for outsourced activities

- have in place an effective risk-management system, as well as a self-assessment of the risk management system (a “risk evaluation for pensions’ or REP), to help schemes become more aware of their commitments to scheme members and the buffers needed in this respect, their funding risk, the assessment of the sponsor support – if any – , the operational risks, the investment risks etc. .

- have in place an outsourcing policy, an effective internal control system and a contingency plan

- a requirement for DC schemes to appoint a custodian, responsible for the safe-keeping and oversight of the scheme’s assets, with a view to reducing operational risk

- etc. .

Member communications

The Commission is also proposing the introduction of a mandatory, standardised, annual communication for occupational pension scheme members across the EU (a pension benefit statement), to provide them with clear and simple information about their individual pension entitlement. The draft Directive sets out what information needs to be included in the new pension benefit statement, with the aim of helping members understand:

- what their replacement income will be after retirement

- what their investment risks are or will be.

Facilitating cross-border activity

The Commission has acknowledged the current complexities for schemes operating cross-border, in particular the need for a scheme in one Member State (referred to as the “home” Member State) to manage members whose relationship with the scheme’s sponsoring employer is subject to the social and labour law of another Member State (the “host” state).

To remove the anomalies of a system which can result in more stringent requirements for cross-border schemes compared with their local counterparts, for example in terms of prudential regulation or investment rules, the Commission is proposing to clarify the procedure for schemes wishing to offer their services in other Member States and the respective roles of the home and host Member States. It is also proposing to introduce a procedure for transferring pension schemes (in whole or part), to a scheme in another Member State.

Rather disappointingly, the rumoured removal of the requirement for cross-border schemes to be fully funded at all times has not materialised.

Investment restrictions and long-term growth

Current restrictions on long-term investments are to be removed, unless they can be justified on prudential grounds. For example, Member States will not be able to restrict schemes from investing in long-term instruments that are not traded on regulated markets, nor investment in non-listed assets that finance low carbon and climate resilient infrastructure projects.

It is envisaged that this move will facilitate investment by pension funds in assets with a long-term economic profile, therefore enabling them to play a greater role in supporting growth in the real economy.

Solvency and capital requirements

The most controversial elements of the original proposals for reform were taken off the table in 2013 in the wake of considerable opposition from around the EU. However, more work is being done behind the schemes on the “Holistic Balance Sheet” (a measure for valuing pension schemes which would require liabilities to be balanced by a mixture of assets, contingent assets, sponsor support and possible access to compensation schemes), and the need for schemes to maintain a risk-based funding buffer. We expect to see further consultations on these measures in autumn 2014.

Next steps

The draft Directive is significantly longer that the 2003 version and contains additional requirements in the field of governance, risk management, information and communication etc. Moreover, it changes the procedure and also to a certain extent the terms and modalities for cross-border IORPs and allows more flexibility in long-term investments. Therefore, it is likely that in all EU member states changes will be necessary.

It is expected that national states will be required to bring the Directive into national law by 31 December 2016.

Canada Aims to Sell Its Oil Beyond U.S.

Producers Want to Diversify but Are Stymied by Poor Access to Ocean Ports

By Chester Dawson

Updated June 5, 2014 10:41 p.m. ET

Last fall, Canadian oil producer Husky Energy Inc. sent a batch of crude on a journey to India. It was just a drop in a sea of global oil transactions, but a step toward reshaping North American energy trading. The million-barrel shipment to Indian Oil Corp. , described by Husky as a test sale, foreshadowed what Canadian producers hope will become many new overseas markets for their oil. “We are doing it opportunistically to have the wheels greased” for more exports far afield if they become feasible, said Asim Ghosh, Husky’s chief executive. Recently, Husky also shipped a batch of oil to Italy’s Eni SpA.

While the U.S. debates whether to loosen a decades-old prohibition on shipping its oil overseas, Canada is quietly positioning itself to become a significant exporter of North American oil beyond the continent.

Canada’s producers long ago came to rely on the U.S. to buy almost all of their exports, in an era when the American appetite for imported oil seemed sure to continue growing steadily. But that appetite is easing, thanks to the U.S. oil-shale boom, even as Canada’s rich oil sands keep producing ever more oil. That leaves Canada a country with too much oil and not enough buyers.

Overseas markets could solve this problem, and probably bring higher prices to boot. But there is one major obstacle. Canada’s long reliance on the U.S. market has left it with few ways to get its oil to ocean ports.

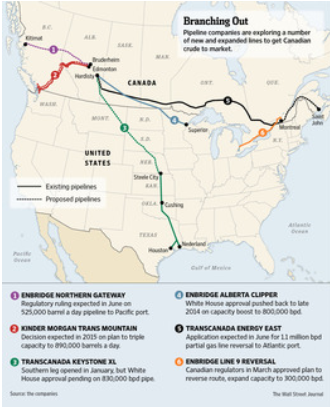

A half-dozen new or expanded pipelines are planned, but are years from being built. These include the proposed Keystone XL tying Alberta’s oil sands to the Gulf of Mexico, a project that remains uncertain amid environmental and political opposition.

Some Canadian producers are so intent on finding new markets they are looking to a loophole in the U.S. rules against oil exports. The rules apply only to U.S.-produced oil, so Canadian producers can apply for licenses to ship oil to the U.S. Gulf Coast and then re-export it to distant lands from there.

“This could be the next big game changer for the North American crude-oil markets,” said Martin King, vice president of institutional research at FirstEnergy Corp. , an investment bank in Calgary, Alberta. “Re-exports of Canadian crude, mostly out of the Gulf Coast, are going to change the industry,” he said.

To make that happen, producers have to jump through some hoops, including segregating batches of overseas-bound Canadian crude from U.S.-produced crude. Canadian Natural Resources Ltd. has suggested color coding. “As long as you color it properly and segregate it, you can re-export it out of the U.S., including U.S. Gulf Coast,” said Réal Cusson, an executive of the oil-sands producer, at an investor conference last year.

The company said it had no specific plans to re-export crude, but some evidently do. The U.S. Department of Commerce granted more than 50 permits to export crude oil in the six months through March, targeting destinations such as Japan, South Korea and Spain. One permit went to a U.S. subsidiary of Canadian pipeline operator Enbridge Inc.

The trade publication Platts has reported a plan by Madrid-based Repsol SA to import around 550,000 barrels of Canadian oil via the Gulf of Mexico. The exporter’s identity isn’t clear. Repsol declined to comment.

Reaching for customers beyond North America could allow oil-sands producers to get higher prices than in the U.S., where their output—so heavy it has the consistency of peanut butter—sells at a discount. Called Western Canadian Select, it fetches less than West Texas Intermediate because of transportation costs, lower quality and limited access to U.S. refineries that can process it, although the gap has narrowed lately.

The Canadian Chamber of Commerce has said oil-sands producers could get $50 million a day more for their output if it were sold outside the continent, citing a 2012 CIBC World Markets report.

A Canadian shift toward non-U.S. buyers could have consequences for bilateral trade, energy policy and even political ties between Ottawa and Washington. Despite its shale boom, the U.S. still relies on Canada for a third of America’s nearly eight million barrels a day in net oil imports and will continue to need Canadian oil.

The U.S. Energy Information Administration projects that domestic American oil production—estimated at 8.4 million barrels a day this year—will climb to 9.6 million barrels a day by 2019, and will stay at or above 7.5 million barrels daily through 2040.

Meanwhile, U.S. imports have fallen each year for nearly a decade. In 2005, the U.S. imported 60% of the oil and oil products it used. That was down to 40% in 2012 and is projected to bottom at 23% later this decade.

The U.S. will remain a net importer of crude oil for decades, and Canada its leading supplier, say industry officials on both sides of the border. But for Canada, demand from the U.S. won’t be enough to soak up all of the output from the vast oil-sands deposits under Alberta’s boreal forests as projects keep coming on stream and increasing output.

Companies active in the oil sands are investing about $30 billion a year to expand production, according to Peters & Co., a Calgary-based investment bank. Oil-sands production is up 71% since 2007 and is forecast by research firm IHS Inc. to double to 3.8 million barrels daily by 2025.

Producers have been caught off guard in betting on a single big customer to the south. If they fail to find new buyers, the oil sands, which rank among the world’s largest industrialization projects, could also turn into one of its biggest white elephants.

“For an industry of the size and strategic importance of the oil sands, it makes absolute sense that we have more than one customer,” said Steve Williams, the CEO of Suncor Energy Inc., one of the main oil-sands producers. “It’s crazy for [production] numbers of national importance and for Canada’s future to be dependent on one customer.”

So far, exports to destinations other than the U.S. remain a fraction of production. Although such shipments more than doubled last year, they averaged a mere 82,955 barrels a day, according to Canada’s National Energy Board, while Canada’s total oil exports were closer to 2.5 million barrels daily.

Much of the oil going to non-U.S. buyers came from offshore wells in eastern Canada, including the oil sent to India and Italy by Husky Energy, which is Calgary-based but majority-owned by entities controlled by Hong Kong billionaire Li Ka-shing; 99.3% of exports from western Canada’s landlocked oil sands went to the U.S.

Canadian producers are racing to secure capacity on railroads and pipelines, including proposed ones. Worries about market access forged an informal consensus in the past year between the industry and provincial governments to fast-track a 2,858-mile pipeline from Alberta and Saskatchewan to Canada’s East Coast.

The TransCanada Corp. project, known as Energy East, would carry 1.1 million barrels of oil a day to refineries in Quebec and coastal New Brunswick. While still needing a federal signoff, the project looks increasingly likely to be built—but not until 2018.

“The Energy East pipeline will connect western Canada to global markets. Once you’re in the water, you can get oil around the world at a very, very low price,” said Husky’s Mr. Ghosh. He said the pipeline would make it as cheap to ship oil-sands crude to markets such as India from the Atlantic coast as from Canada’s Pacific coast.

Five years ago, when TransCanada proposed extending its existing Keystone system with a direct Alberta-to-the Gulf route called Keystone XL, few in the oil sector or in Ottawa foresaw how much it would get caught up in U.S. politics and environmental debate.

Oil-sands producers also didn’t anticipate the degree of competition for pipeline space they would face from light crude from shale in U.S. states such as North Dakota.

An early wake-up call came in the fall of 2010. Enbridge temporarily closed a pipeline connecting western Canada to Chicago-area refineries after a spill near Romeoville, Ill., which followed a larger spill in Kalamazoo, Mich. The bottleneck spurred a rush by Canadian producers to secure railroad tank cars and to push for construction of new pipelines.

Both efforts have since accelerated. In 2012, Canada exported an average of 46,000 barrels of oil a day to the U.S. by rail. In this year’s first quarter, it was more than 160,000 barrels daily.

While a spate of fiery derailments has shown the risk in shipping oil by rail, producers of the oil sands’ heavy crude say it is far less volatile than the lighter shale-oil crude. Peters & Co. projects that as new rail loading terminals are built, western Canada’s crude-by-rail capacity may reach 1.1 million barrels daily by the end of next year.

That would exceed the proposed Keystone XL’s 830,000 barrels daily capacity, and would help soak up the oil sands’ output.

Even so, two million more barrels a day of pipeline capacity will be needed to meet crude-oil growth forecasts through 2025, the Canadian Association of Petroleum Producers estimates.

Half a dozen projects are proposed to meet that demand. They face strong opposition both from environmentalists and from the aboriginal people who control much of the land through which pipelines, especially to the Pacific, would have to pass.

Some Canadian oil producers are pulling back on expansion projects amid the uncertainty. Barclays PLC estimates that concern about distribution bottlenecks has deferred projects totaling 500,000 daily barrels through 2016. Last week, Total SA ‘s Canadian unit suspended an oil-sands project in the works for nearly a decade, citing rising costs and concern about its ability to generate profits.

Other producers are hedging their pipeline bets. “We have participated in multiple new pipeline offerings,” said Rich Kruger, chief executive of Exxon Mobil Corp.’s Calgary-based Imperial Oil Ltd. unit. He described rail as “an insurance policy if pipelines ultimately don’t come about in the time that we would need them.” Husky, Suncor and Canadian Natural Resources also have committed to using proposed pipelines.

At present, Canada’s Pacific coast is served by only one, 60-year-old oil pipeline, called the Trans Mountain. Its operator, a Canadian unit of Kinder Morgan Energy Partners LP, routinely receives bids to move three times as much oil as the pipeline can carry. Most oil traveling on it goes to refiners in Vancouver and Washington state.

A trickle has made it to China. In 2012, oil-sands producer Cenovus Energy Inc. used the pipeline to ship about 250,000 barrels to the coast and then on to a Chinese buyer. Cenovus says it wants to send more but faces shipping-capacity limits.

Among the projects proposed is a tripling of the Trans Mountain’s capacity. Another is a pipeline from the oil sands to British Columbia’s north coast. Cenovus has earmarked shipments on both, in hopes of selling to Asian customers.

Some smaller Canadian shale-oil producers, including Crescent Point Energy Corp. , plan to start exports to China later this year by using rail access to the Gulf of Mexico and Pacific coasts. Abroad, the company could get $5 to $10 a barrel above what U.S. buyers pay for light and medium Canadian crude from shale deposits, Crescent Point CEO Scott Saxberg figures.

Freed from their role as captive sellers, Canada’s producers might find the U.S. market less beguiling, and Americans might no longer be able to count on as much relatively cheap Canadian oil.

Said Rick George, a former Suncor CEO who is now a partner at Calgary-based Novo Investment Group: “If you produce a commodity, you never want to be in a position where your customer has more bargaining strength than you do.”

Write to Chester Dawson at chester.dawson@wsj.com