Today’s Labor Updates:

Poll Shows Growing Support for Right-to-Work Laws … Even Among Democrats

Expensive Mistakes: Assessing the Need for Wage and Hour Compliance

Poll Shows Growing Support for Right-to-Work Laws … Even Among Democrats

Rob Nikolewski September 08, 2014 /

Vice President Biden delivered a fiery speech in support of unions at a Labor Day appearance in Detroit last week. But a recent Gallup poll painted a sobering picture for union backers.

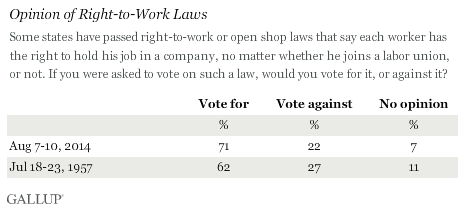

When asked if they would vote for right-to-work laws, 71 percent of Americans—and 65 percent of Democrats—said they would.

That’s 9 percentage points higher than in 1957, when the U.S. economy was riding a post-war wave that saw union participation at record numbers.

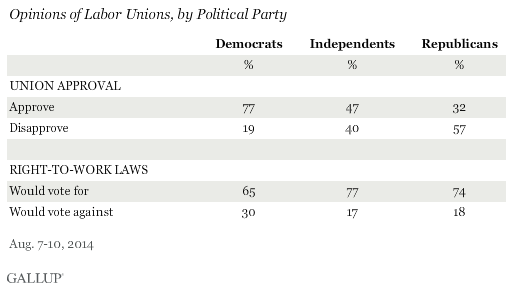

The Gallup survey showed a political divide when it came to opinions about labor unions, with 77 percent of Democrats approving and 57 percent of Republicans disapproving. Independents approved of unions by a margin of 47 percent to 40 percent.

But when specifically asked about approving of right-to-work laws, even Democrats came out in favor by a 35-point margin.

“People may not have completely understood the question, but beyond that, I think [the Gallup poll] reflects the decreasing presence and powers of unions in the country,” said Joseph Slater, law professor and labor expert at the University of Toledo. “They haven’t gotten their message out to people who are skeptical of unions.”

Some 24 states have right-to-work laws, which give employees the right to decide for themselves whether to join or financially support a union. In 2012, Michigan became the most recent state to pass right-to-work legislation, even though some consider it the cradle of the U.S. labor movement.

Supporters say right-to-work laws ensure personal freedom and attract businesses and point to the booming economies of North Dakota and Texas as examples.

Detractors call the laws “right-to-work-for-less” and point to the generally higher level of pay and benefits workers receive in states that don’t have the law in place.

The political battle lines are forming for potentially more states to join the right-to-work contingent, including Missouri, Kentucky and New Mexico.

Expensive Mistakes: Assessing the Need for Wage and Hour Compliance

- Resource type: Legal Update: archive

- Status: Law stated as at 26-Aug-2014

- Jurisdiction: USA

Wage and hour claims continue to pose significant risks to employers. This Update cites a recent study on those risks and highlights a Practical Law wage and hour audit resource that can help avoid costly compliance failures.

Practical Law Labor & Employment

US corporations continue to face significant legal and financial exposure because of wage and hour claims. According to a November 2013 study of wage and hour settlements by NERA Economic Consulting, companies paid an average of $4.5 million to resolve a wage and hour claim in the first three quarters of 2013. This number shows a decline from the average of $7.5 million reached overall between 2007 and 2012. However, the 2013 median settlement of $2.8 million is the highest the study’s authors had seen since 2008.

The study notes that from 2010 to September 2013, the per-plaintiff settlement value of wage and hour claims has risen every year, with the 2013 average at just under $7,000. Cases with the largest class size of 1,000 members or more have been on the decline since 2007, but the most common class size of between 100 and 499 members still presents a costly risk to most employers, given the per-plaintiff settlement value estimate.

Wage and hour claims cut across industries. The study’s authors found claims against businesses in financial services, insurance, food service, health care, manufacturing, retail, technology, telecommunications, transportation and others. The study looked at the kinds of claims alleged and the percentage of the total settlement assigned to each claim type. They found that between January 2007 and September 2013, the numbers broke down as follows:

- Overtime: 40%.

- Misclassification: 17%.

- Off-the-clock work: 16%.

- Missed meals and break periods: 16%.

- Donning and doffing: 4%.

- Minimum wage claims: 4%.

- Tip pooling: 2%.

One takeaway from these findings is that wage and hour compliance is a dynamic obligation. It requires a broad range of compliance activities, not simply ensuring proper payment of overtime or for meal and break periods. Therefore, conducting an internal audit of wage and hour practices can help employers promote wage and hour compliance and avoid the significant financial risks the study highlighted.

Practical Law offers resources to help, including Practice Note, Conducting an Internal Wage and Hour Audit (www.practicallaw.com/3-507-2028), which provides an overview of internal wage and hour audits under the FLSA, including:

- Preliminary issues employers should consider before conducting an internal audit.

- Common wage and hour issues to evaluate as part of the audit.

- How to respond to compliance issues discovered during the audit.

- Best practices for going forward after the audit.

The study, Trends in Wage and Hour Settlements: 2013 Update, is available on NERA Economic Consulting’s website